Trusted by

Trusted by

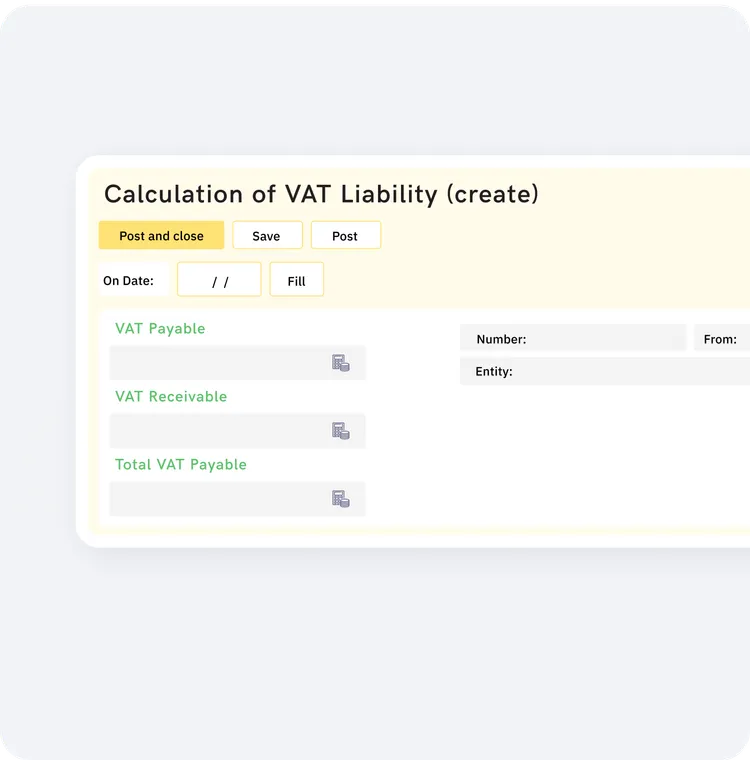

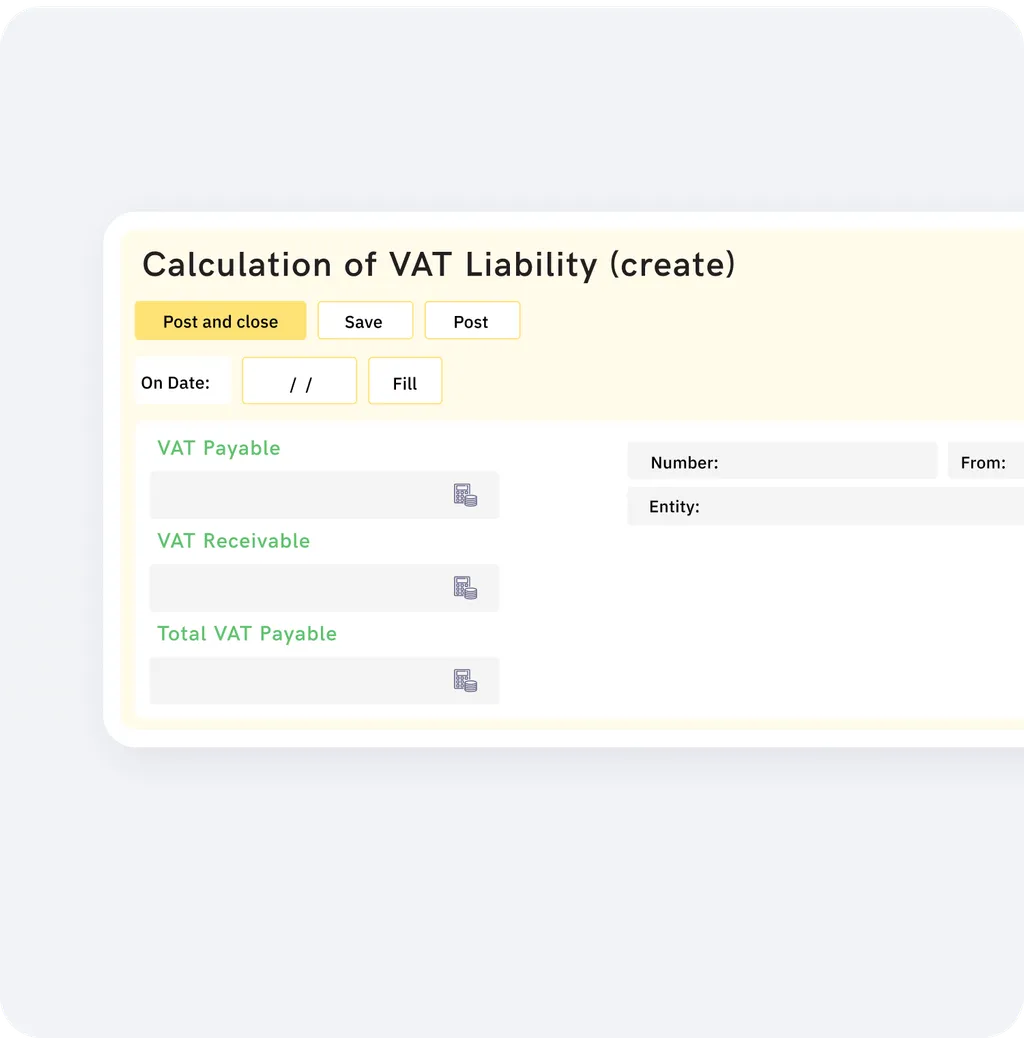

CALCULATE

Ensure accurate tax calculations

-

Automatically calculate VAT and Withholding Tax (WHT) in compliance with Saudi regulations

-

Maintain real-time, error-free tax records across all financial operations

-

Sync tax data with accounting, payroll, and procurement to eliminate discrepancies

Request a demo

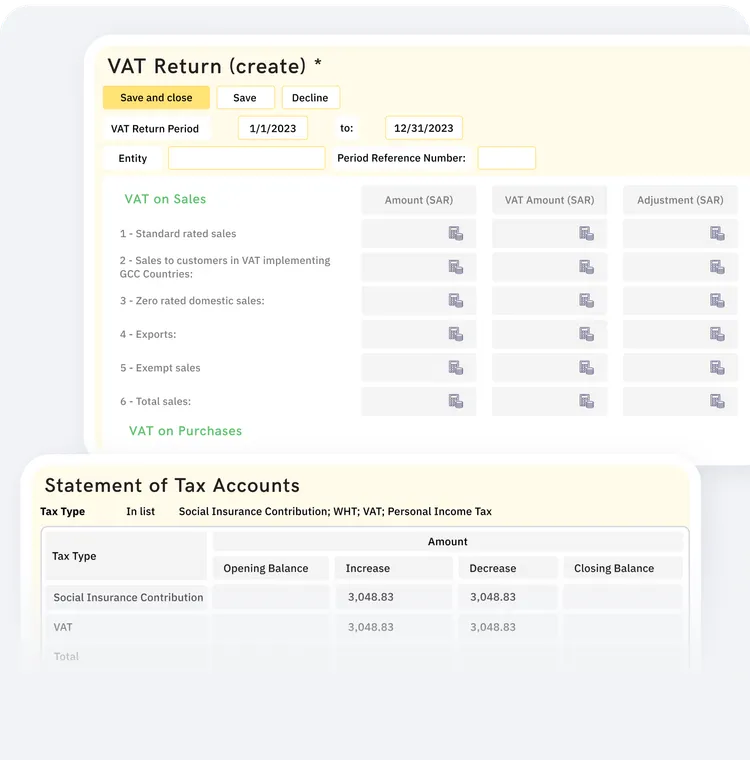

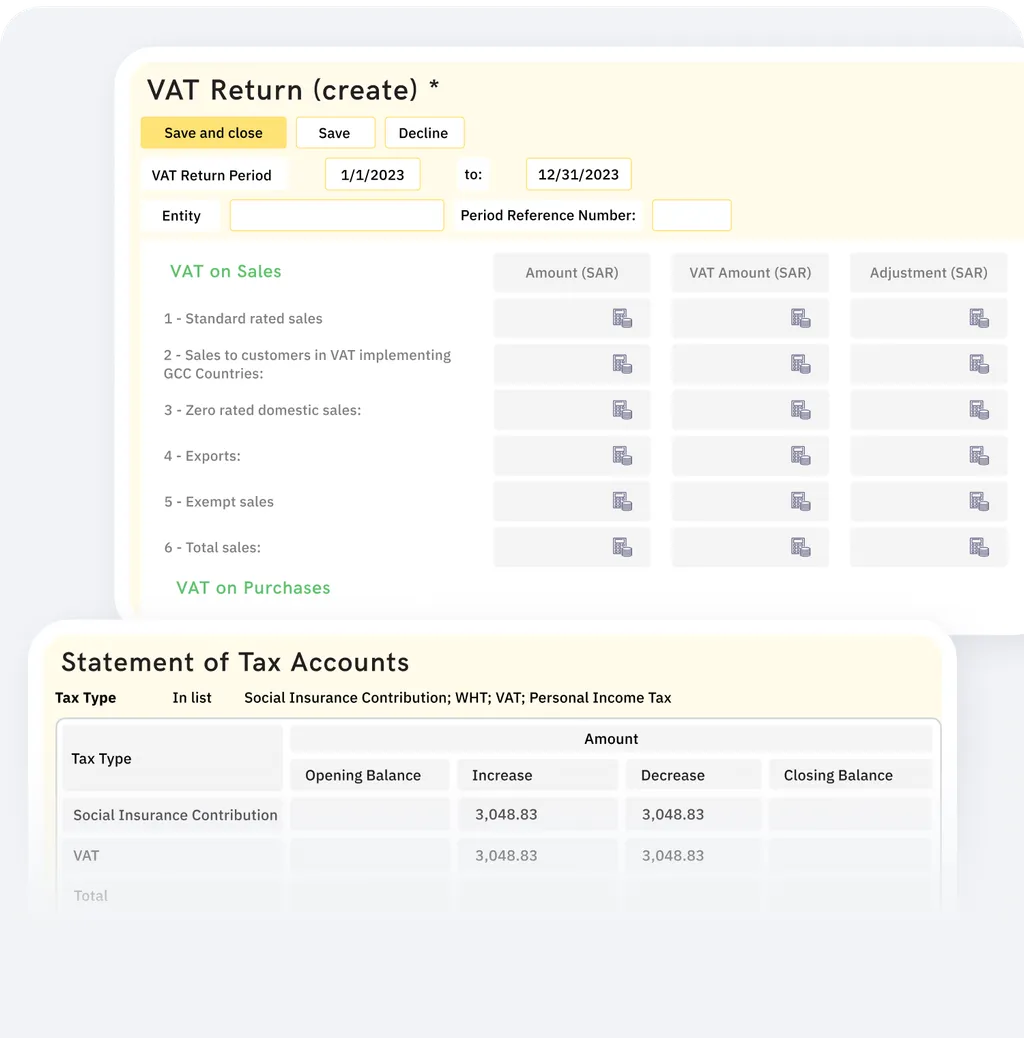

REPORT

Simplify tax return preparation

-

Generate VAT Returns as per ZATCA format and submit them on time

-

Automate the creation of WHT Returns for payments to non-residents in a system that is fully VAT compliant

-

Access reports for payroll tax contributions to maintain full transparency and compliance

Request a demo

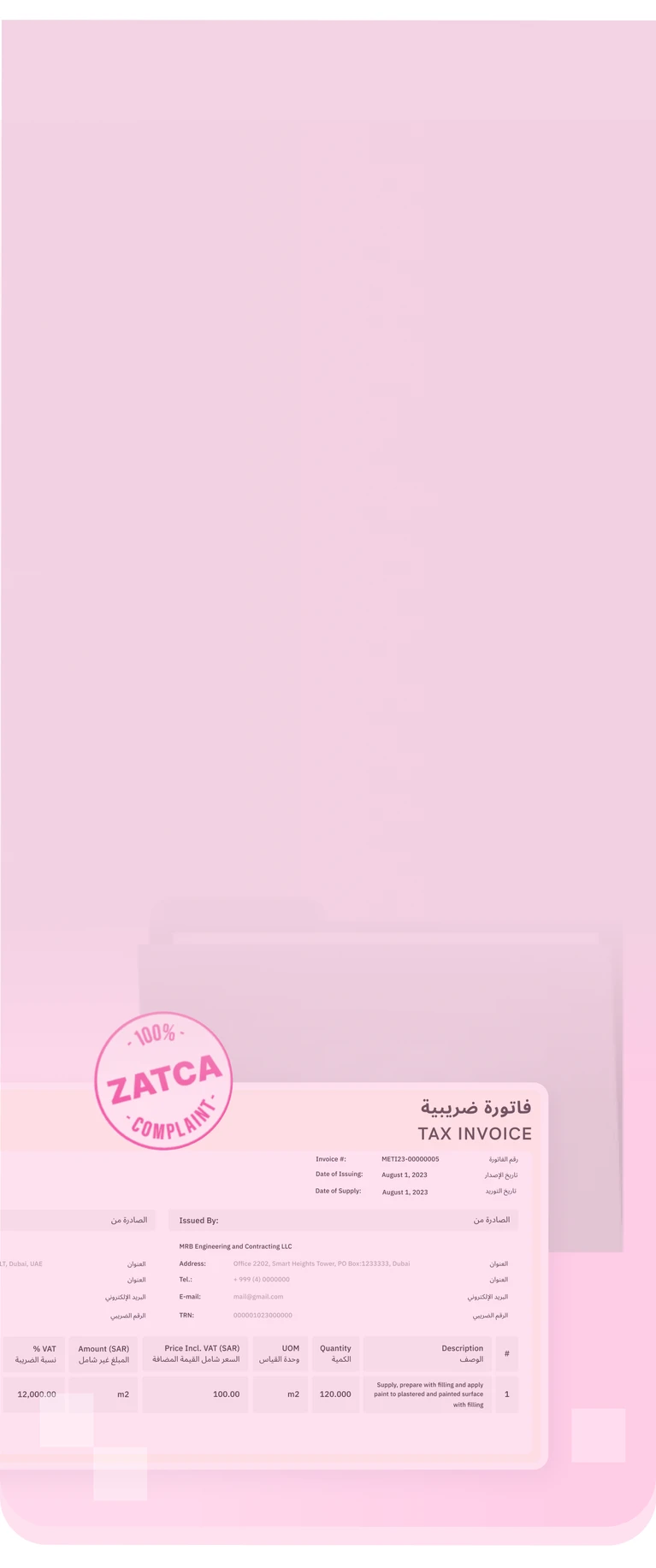

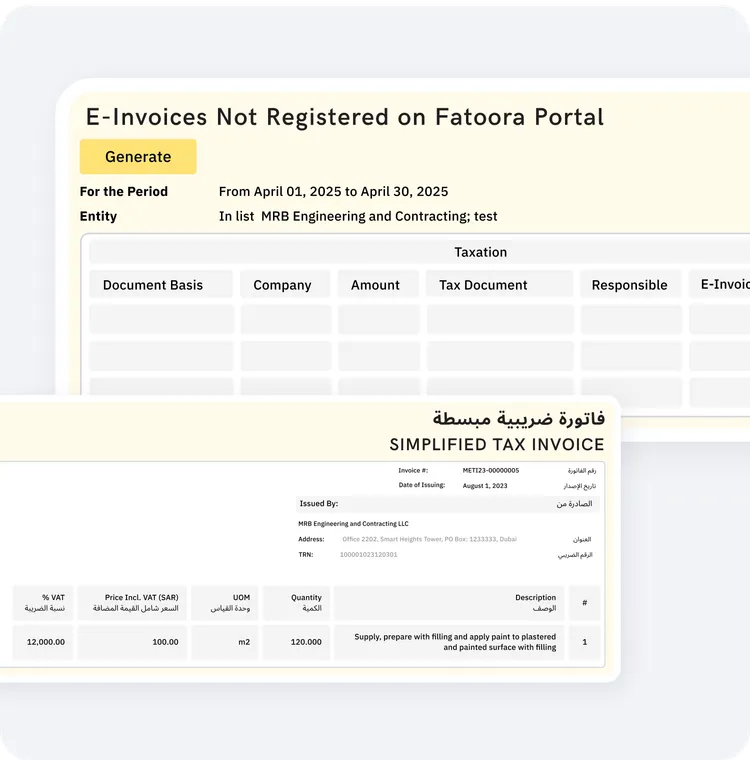

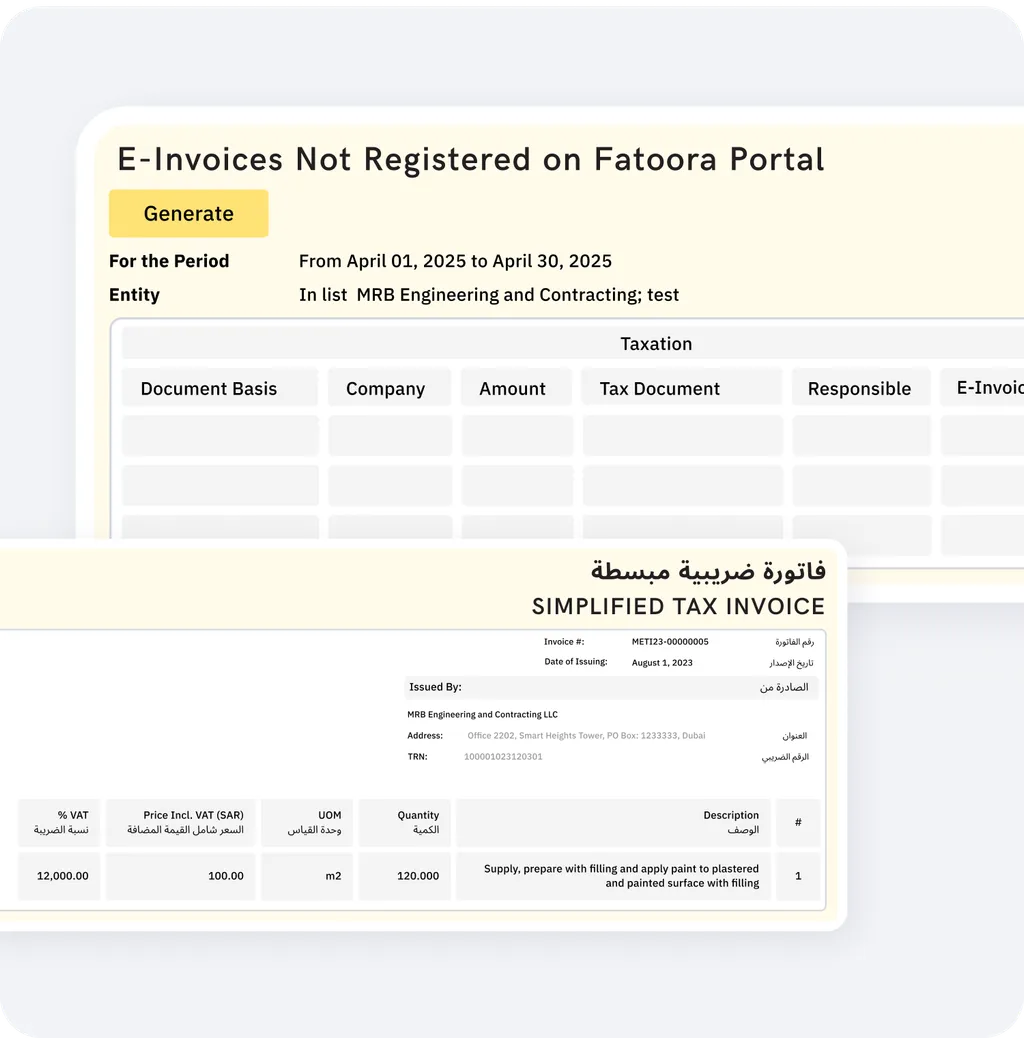

E-INVOICE & COMPLY

Stay compliant with ZATCA e-invoicing

-

Generate and send electronic invoices directly to the Fatoora portal with digital signatures in line with Phase 2 of ZATCA e-invoicing

-

Monitor unregistered e-invoices with specialized reports

-

Ensure your system is always audit-ready with structured, bilingual (EN-AR) document templates for the e-invoices

Request a demo

Achieve your goals with these features

Here are FirstBit ERP tools and reports to enable full tax compliance in your construction business in Saudi ArabiaGet to know how First Bit makes your business grow

Frequently asked questions

Don't find an answer? Meet our expert to get a detailed quote.

Contact us

What is KSA tax compliant software?

What tax types are supported in FirstBit ERP for Saudi Arabia?

What reports can I generate with the FirstBit Taxes module?

Does FirstBit ERP integrate tax processes with accounting?

Does FirstBit ERP support Phase 2 of ZATCA e-Invoicing?

Can I calculate WHT for payments to non-residents?

Can FirstBit ERP handle multi-currency tax calculations?

Does the system handle payroll tax and contribution calculations?

Are tax documents bilingual in KSA?

Don't find an answer? Meet our expert to get a detailed quote.

Contact us

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.