Saudi Arabia’s construction sector is entering a decisive stage of transformation. In 2025, innovation is no longer optional; modular building, green standards, and construction technology trends are shaping how projects are conceived and delivered.

Fueled by Vision 2030, the Kingdom is investing heavily in infrastructure, housing, and tourism to build cities that are smarter, faster to complete, and environmentally responsible. These trends in construction are reshaping every layer of the industry, from design and materials to data management and compliance.

The future of construction industry in Saudi Arabia is now defined by precision, sustainability, and integration. Contractors adopting new trends in construction technology, such as digital twins, prefabrication, and real-time monitoring, are not just meeting demand; they are helping set the benchmark for the region’s next generation of development.

Construction Market Size and Forecast

Saudi Arabia remains the GCC’s largest, most active construction market. In 2025, activity is supported by

Vision 2030 programs across housing, transport, tourism, and utilities. Private participation and PPP structures continue to deepen the pipeline and improve delivery certainty.

Near term, analysts expect steady expansion as megaprojects move from design to execution. Contractors are scaling capacity, digitizing cost control, and adopting modular methods to meet timelines. These moves reflect broader construction trends toward faster, cleaner, and more transparent delivery.

IMARC projects that the Saudi construction market will rise from USD 97.8 billion (2024) to USD 135.6 billion by 2033, at a ~3.7% CAGR, signaling durable, policy-backed growth[?].

This steady outlook guides investment and planning across 2030 megaprojects. It also explains why new trends in construction technology and modular methods now receive higher budget priority. Contractors that adapt early to these shifts will stay competitive as the future of construction industry in Saudi Arabia becomes faster, leaner, and more data-driven.

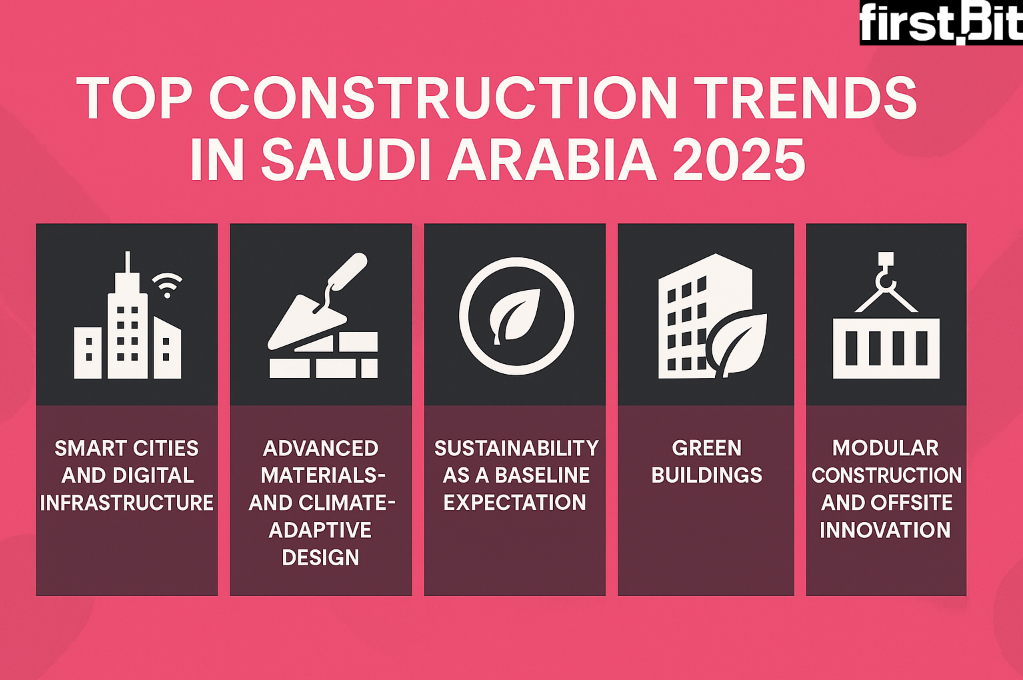

Top Construction Trends in Saudi Arabia 2025

Top Construction Trends in Saudi Arabia

With market expansion firmly underway, the industry’s focus in 2025 has shifted toward smarter, greener, and faster ways of building. Contractors are embracing digital tools, sustainable materials, and modular systems that improve efficiency and meet Vision 2030 performance targets.

These construction trends illustrate how Saudi Arabia’s growth model is evolving from volume-driven development to innovation-led execution.

Smart Cities and Digital Infrastructure

Saudi Arabia’s megaprojects are redefining how cities operate. At

NEOM’s

The Line, thousands of sensors and AI-driven control systems connect transport, energy, and utilities into a single digital ecosystem.

This model reflects a broader movement toward data-led infrastructure, where cities continuously adapt to demand, resource flow, and climate conditions.

According to Globe Newswire, Saudi Arabia’s construction industry is projected to grow 4 percent in 2025, with an average 5.4 percent annual rate from 2026 to 2029, largely supported by infrastructure and smart-city projects[?].

Other reasons for this growth are major investments into housing, energy, and transport infrastructure, including preparatory spending ahead of the FIFA World Cup 2034[?].

These connected developments signal how construction technology trends are shaping the future of construction industry, integrating digital management into every stage of urban planning.

Advanced Materials and Climate-Adaptive Design

The Kingdom’s demanding environment is accelerating the use of high-performance materials — a key aspect of emerging construction trends in the region. Buildings such as the King Abdulaziz Center for World Culture in Dhahran feature smart glass and insulated façades that reflect heat while maintaining indoor comfort.

Across the sector, self-healing concrete, composite panels, and adaptive shading systems are becoming common as developers pursue energy-efficient, low-maintenance structures.

These innovations align material science with sustainability goals, helping reduce lifecycle emissions and operational costs across Saudi Arabia’s building stock.

Sustainability as a Baseline Expectation

Sustainability has transitioned from a branding exercise to a core operational requirement. Solar power, greywater recycling, and low-carbon materials are now standard design elements in large projects.

The approach taken by Red Sea Global’s regenerative tourism developments, which rely fully on renewable energy and off-grid infrastructure, shows how environmental accountability has become central to commercial success.

This integration of policy, finance, and design ensures that sustainable building practices are now embedded in the country’s construction DNA. It aligns with evolving construction trends toward holistic, purpose-driven development.

Green Buildings

At

King Abdullah Financial District (KAFD) in Riyadh, buildings designed to LEED criteria demonstrate how sustainable architecture enhances both environmental performance and long-term asset value.

These frameworks are shifting perception: green compliance is now viewed as a measure of quality rather than a regulatory hurdle, clearly indicating how trends in construction are shifting investor expectations. As adoption broadens, the Kingdom is laying the groundwork for a built environment that prioritizes efficiency, resilience, and occupant well-being.

Modular Construction and Offsite Innovation

Modular construction is quickly gaining traction as developers seek speed and precision. Prefabricated units produced in factory conditions are transported and assembled on site, reducing waste and minimizing delays.

The staff villages at Red Sea Global were built using this approach, with fully finished modules installed in weeks instead of months, proving that modular techniques can deliver scale without compromising quality.

By combining offsite manufacturing with BIM and robotics, Saudi contractors are demonstrating how new trends in construction technology translate directly into faster, safer, and more sustainable delivery.

Equipment, Machinery, and Productivity Tools

Digital transformation now extends deep into the field. At Diriyah Gate, drone mapping, IoT-enabled machinery, and cloud dashboards give project managers real-time insight into equipment use and workforce safety.

AR-based training and predictive-maintenance software are further improving uptime and reducing human error across large project sites.

These technologies show that the future of construction in Saudi Arabia depends not only on advanced materials and methods but also on the ability to turn data into measurable productivity gains.

New Trends in Construction Technology

Saudi Arabia’s construction ecosystem is becoming one of the most technologically advanced in the world.

Digital tools, automation, and real-time analytics are redefining how projects are planned, monitored, and managed. These construction technology trends are laying the foundation for a smarter, more transparent industry.

Robotics and AI-Driven Automation

Automation is moving from design studios to construction sites. Contractors now deploy robotic bricklayers, rebar-tying machines, and automated finishing systems to complete repetitive work faster and with fewer errors.

Artificial intelligence supports scheduling, cost prediction, and safety monitoring—enabling teams to anticipate risks rather than react to them.

At NEOM, autonomous machinery and drones are being used to map terrain, move materials, and monitor progress across vast desert zones—illustrating how robotics is reshaping project logistics and efficiency.

According to PwC, AI could contribute over USD 135 billion to Saudi Arabia’s economy by 2030, accounting for roughly 12.4 percent of GDP[?].

Drones, Remote Sensing, and Site Monitoring

Drones have become indispensable for topographic mapping, safety checks, and progress tracking. They integrate with BIM models to create precise digital records of each stage of construction.

At Diriyah Gate, high-resolution drone mapping supports heritage preservation by monitoring excavation boundaries and reducing on-site inspection time.

Digital Twins and Real-Time Simulation

Digital twins allow developers to replicate and test performance before completion. They combine 3D design data with live sensor feedback from equipment and building systems.

The King Salman Park project in Riyadh uses this technology to model irrigation, energy demand, and maintenance cycles, making the city’s largest green space easier to manage sustainably. This highlights current trends in construction, where digitalization intersects with large-scale infrastructure.

Cloud, Edge Computing, and IoT Platforms

Cloud platforms are streamlining collaboration between engineers, architects, and contractors. Edge computing processes data locally on site, keeping critical systems running even with limited connectivity.

At Jeddah Central Development, cloud-based coordination tools link project design, budgeting, and field operations, ensuring consistent data access for all stakeholders.

Advanced Fabrication Techniques

3D printing and robotic fabrication are turning prototypes into large-scale production tools. Saudi Arabia’s Ministry of Housing has tested 3D-printed villas capable of structural completion in under 48 hours, reducing waste and labor requirements.

Such advances demonstrate how additive manufacturing is moving from experiment to mainstream practice.

Augmented, Virtual, and Mixed Reality

Immersive visualization tools are transforming collaboration. VR lets investors and tenants explore projects before ground-breaking, while AR overlays installation guidance directly onto worksites.

At King Abdullah Financial District, developers use VR walkthroughs for early tenant engagement, reducing design revisions and speeding approvals.

Big Data Analytics and AI in Project Intelligence

Construction data is now treated as a strategic asset. AI-powered dashboards track productivity, forecast overruns, and identify bottlenecks across portfolios.

At Red Sea Global, analytics platforms integrate procurement, logistics, and sustainability data to optimize delivery across multiple coastal sites—showing how information has become central to the future of construction industry in Saudi Arabia.

Future of Construction Industry in Saudi Arabia

Saudi Arabia’s construction industry is evolving from project-based expansion to system-level transformation.

Technology, sustainability, and workforce development are now shaping how the sector will grow beyond 2030

[?]. These shifts reveal what the future of construction in the Kingdom will look like: integrated, efficient, and globally competitive.

Business Models, Technology, and Delivery Evolution

Construction delivery is becoming more integrated and performance-driven. Contractors are adopting models that combine design, build, and long-term maintenance under one digital framework. Offsite construction, BIM coordination, and automated workflows are becoming standard features of major tenders.

The Diriyah Gate project is a clear example of its teams using BIM-based coordination to link design, procurement, and operations across hundreds of buildings, reducing rework and cost overruns.

This approach represents a new generation of construction trends, where technology ensures precision and accountability at every stage.

According to McKinsey’s Global Infrastructure Productivity Report, digital and modular construction methods can raise productivity in large projects by up to 60 percent, underscoring why Saudi Arabia’s modernization efforts emphasize technology adoption[?].

Sustainability, Resilience, and Environmental Mandates

The next decade of development will center on resilience. Saudi Arabia is embedding net-zero and circular-economy principles into national policy, ensuring that every new build aligns with environmental goals.

Projects are being designed to withstand extreme heat, dust storms, and resource scarcity while maintaining long-term efficiency. In the Red Sea Global portfolio, carbon-neutral operations and smart water systems demonstrate how sustainability now defines competitiveness.

Performance tracking and third-party audits are also becoming routine, making environmental transparency part of standard project delivery.

Skills, Workforce, and Institutional Capacity

The construction workforce is evolving as digital tools take center stage. Traditional roles are being supplemented by data analysts, automation specialists, and robotics technicians. To meet these demands, Saudi Arabia is investing in training centers and partnerships between the government and academia.

At NEOM, on-site technology hubs train workers in drone operations, AI-assisted surveying, and modular assembly, ensuring that skill development grows alongside innovation.

This transition highlights how human capital remains at the heart of the future of construction industry.

Saudi Arabia’s Role in the Global Construction Future

Saudi Arabia is positioning itself as a regional hub for construction innovation. Experience gained through Vision 2030’s giga-projects is being leveraged to export expertise in modular systems, sustainability consulting, and digital engineering across the GCC.

Collaborations with global firms are enhancing the Kingdom’s technical capacity while building credibility on international benchmarks.

As its infrastructure expands and its methods modernize, Saudi Arabia is shaping not only its own built environment but also influencing global trends in construction through technology, standards, and policy leadership.

Building the Future: First Bit’s Role in Shaping Saudi Arabia’s Construction Landscape

As Saudi Arabia’s construction sector modernizes, digital systems are becoming essential to achieving the speed, visibility, and compliance required under Vision 2030.

First Bit supports this transformation through an ERP platform purpose-built for the regional construction and contracting environment. Each component of the system addresses a key industry need, from unified control to automation and regulatory compliance.

Unified ERP for Construction and Contracting

FirstBit ERP brings every project operation into one platform. Project control, procurement, accounting, HR, and payroll are connected through a shared database, eliminating duplication and manual handoffs.

This unified approach helps contractors maintain accurate budgets, forecasts, and reports across all active projects.

Interface in FirstBit ERP

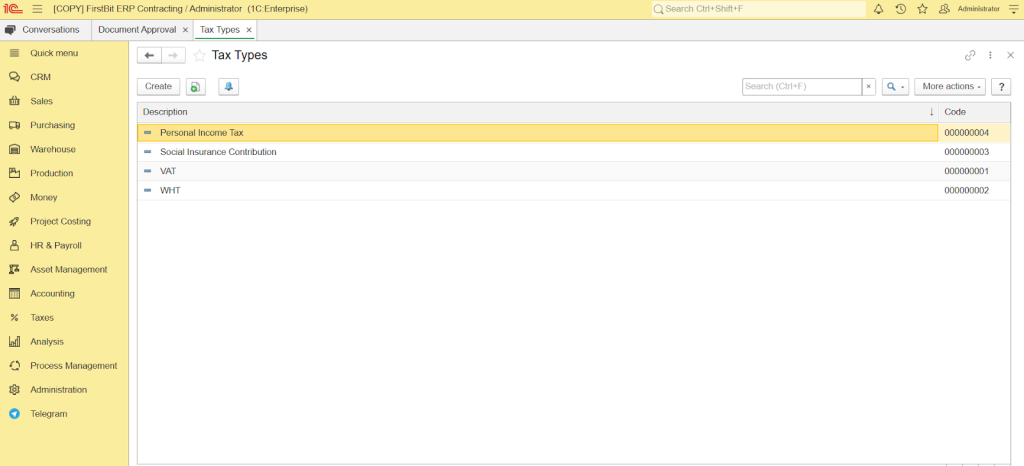

ZATCA and VAT Compliance

The system is fully compliant with ZATCA e-invoicing and Saudi VAT legislation. Invoices are generated automatically in the FATOORA format and integrated directly with the ZATCA portal.

By embedding these local requirements into daily workflows,

First Bit ensures contractors meet evolving digital-compliance standards with minimal effort.

Tax Types in FirstBit ERP

Real-Time Project Control

Contractors can monitor budgets, BOQs, and equipment usage in real time. Interactive dashboards provide visibility into costs, materials, and labor progress across multiple job sites.

This transparency allows managers to make timely adjustments, reducing delays and preventing overspending.

Cloud and On-Premise Deployment

First Bit offers both cloud and on-premise deployment options to fit different IT policies. Companies can choose the model that best meets their security and scalability needs and migrate easily as their operations grow.

This flexibility is particularly valuable for mid-sized contractors expanding into multiple regions.

Built for Regional Construction Workflows

Unlike generic ERP systems,

FirstBit ERP is localized for Middle Eastern construction operations. It supports bilingual interfaces (English / Arabic), regional accounting standards, and local HR and payroll rules.

More than 2,000 businesses across the UAE and Saudi Arabia already use the system to manage complex project portfolios.

Automation and Operational Efficiency

Automation is central to

First Bit’s design philosophy. Processes such as purchase approvals, payroll preparation, and reporting are digitized, minimizing manual input and human error. Teams gain back time to focus on strategic planning and project delivery rather than routine administration.

By embedding these capabilities into everyday workflows, First Bit enables Saudi contractors to operate with greater accuracy, agility, and compliance.

Its region-specific ERP ecosystem positions it as a long-term technology partner driving the future of the construction industry across the Kingdom.

Conclusion

Saudi Arabia’s construction industry is no longer defined by scale alone; it’s defined by transformation and emerging trends in construction that are reshaping the sector.

The industry is evolving into a digitally connected, environmentally conscious ecosystem where innovation is measured not just in design but in performance, transparency, and long-term value.

As Vision 2030 projects continue to reshape the built environment, the companies that thrive will be those able to integrate technology, sustainability, and operational discipline into every phase of delivery.

From modular methods and digital twins to regulatory compliance and workforce upskilling, each advancement is pushing the market toward global best practice. This momentum signals that the future of construction in Saudi Arabia is not a distant vision; it’s already underway, driven by a new generation of construction trends.

For developers, contractors, and technology partners alike, the challenge now is to maintain this pace of innovation while ensuring that growth remains resilient, data-driven, and sustainable for decades to come.

FAQ

What are the biggest construction trends in Saudi Arabia for 2025?

Key construction trends include modular building, digital transformation, green standards, and AI-driven project management. Smart cities like NEOM and Red Sea Global are setting new benchmarks for sustainability and automation, shaping the future of construction across the region.

How is digital transformation changing construction in Saudi Arabia?

Contractors are replacing spreadsheets with integrated ERP systems that connect finance, procurement, and site operations in real time. This shift improves cost visibility, reduces delays, and ensures compliance with Saudi VAT and ZATCA e-invoicing regulations.

Why is modular construction gaining traction in 2025?

Modular methods shorten delivery timelines, improve quality control, and reduce waste. Projects such as Red Sea Global’s staff housing demonstrate how new trends in construction technology can combine speed, scalability, and sustainability in one process.

How are companies ensuring compliance with Saudi tax and e-invoicing laws?

Most contractors now rely on ERP platforms certified by ZATCA to issue digital invoices in the FATOORA format. Systems like First Bit ERP automate VAT calculations, integrate with government portals, and maintain full audit trails to meet local compliance standards.

How are AI and data analytics improving project performance?

AI tools analyze cost patterns, equipment data, and schedule progress to predict potential delays and cost overruns. By turning daily site data into actionable insights, they help contractors make faster, more informed decisions, a defining factor in the future of construction industry.

What role do sustainability standards play in Saudi construction today?

Sustainability has become a baseline requirement. The Saudi Green Building Code (SgBC 1001) and the MOSTADAM certification system require measurable performance in energy, water, and materials, embedding environmental accountability into every stage of development.

Umme Aimon Shabbir

Editor at First Bit

Aimon brings a deep understanding of the modern construction business to her articles. Her strength is providing practical content that enhances users’ understanding and usage of the software in the industry. As an editor, Aimon helps our authors reach their full potential and produce their best work.