Construction accounting in Saudi Arabia comes with its own set of rules. Between SOCPA’s IFRS-endorsed standards, ZATCA’s VAT requirements, and the Ministry of Commerce’s recordkeeping laws, accounting teams have to manage far more than ledgers and invoices. Each project and every contract carries legal and tax implications that directly affect cash flow, compliance, and financial reporting.

Since January 2017, all publicly accountable entities in Saudi Arabia have been required to apply IFRS Standards as endorsed by SOCPA, bringing local reporting in line with international frameworks[?].

As of 2025, construction firms face tighter integration between accounting, VAT, and Zakat reporting. The latest ZATCA amendments have changed how VAT groups, e-invoicing, and input deductions are handled, areas that sit at the core of accounting for construction contracts.

This guide explains how each regulation connects to your daily operations. It outlines the roles of SOCPA, ZATCA, CMA, and the Ministry of Commerce, the main accounting rules for projects under construction, and how modern construction accounting software can help meet these requirements without disrupting project timelines or financial accuracy.

Key Regulatory Bodies in Saudi Arabia

Understanding the regulatory structure is the first step toward compliant accounting for construction contracts. In Saudi Arabia, several authorities define how businesses prepare financial statements, report taxes, and maintain audit standards. Each plays a specific role in shaping how construction accounting is performed, from project-level billing to annual audits.

A recent study on Saudi-listed firms found that the average compliance with IFRS standards was 79%, highlighting ongoing efforts to strengthen financial reporting quality in the Kingdom[?].

SOCPA (Saudi Organisation for Chartered and Professional Accountants)

SOCPA is the national authority responsible for setting accounting and auditing standards. It endorses and translates IFRS Accounting Standards for local use and issues additional technical pronouncements where needed, covering topics like Zakat accounting, Islamic finance transactions, and local disclosure requirements.

For construction companies, SOCPA standards guide how projects under construction are valued and how revenue is recognized under IFRS 15. It ensures that reporting reflects actual project progress and costs, not just cash flow timing.

Every practicing accountant and auditor must be licensed under SOCPA and maintain compliance with its professional ethics and continuing education requirements.

Capital Market Authority (CMA)

The

CMA oversees listed companies and enforces disclosure, financial reporting, and corporate governance standards. All publicly accountable entities listed on Tadawul must report under IFRS as endorsed by SOCPA, ensuring comparability across industries.

For major construction groups or infrastructure developers, CMA compliance means disclosing project risks, commitments, and related-party transactions transparently. Even unlisted contractors that work on projects with listed entities are often required to align with CMA standards to satisfy audit and vendor requirements.

Zakat, Tax and Customs Authority (ZATCA)

ZATCA governs VAT, Zakat, corporate income tax, and customs. For the construction sector, it has a direct influence on revenue recognition, retention accounting, subcontractor payments, and cross-border transactions.

ZATCA mandates e-invoicing (Fatoorah) for all VAT-registered businesses, enforces the 15% VAT rate, and monitors input-VAT claims. Failure to issue compliant e-invoices or retain adequate documentation can result in fines or disallowance of VAT recovery.

Construction companies must also align their accounting software for construction company operations with ZATCA’s technical and timing requirements for tax points, retention releases, and progress-payment schedules.

In addition, ZATCA supervises Zakat assessments for Saudi-owned entities and withholding tax on payments to non-resident service providers, two areas that often intersect with long-term construction contracts.

Ministry of Commerce / Ministry of Finance

The

Ministry of Commerce (MoC) enforces the

Law of Commercial Books (Royal Decree No. M/61, 1989), requiring businesses to maintain Arabic-language accounting records, journals, ledgers, and inventory books for at least ten years. It also regulates business registration and licensing, ensuring traceable and auditable financial documentation.

The Ministry of Finance (MoF) works in coordination with SOCPA to ensure consistent fiscal reporting practices and proper application of endorsed IFRS standards across both public and private sectors. For companies engaged in government infrastructure projects, MoF guidelines govern how progress billings, retentions, and advances should be recorded and reported.

Together, these ministries create the administrative and legal framework that underpins accounting for construction company operations in the Kingdom, establishing how records are kept, verified, and used to demonstrate compliance before regulators and clients alike.

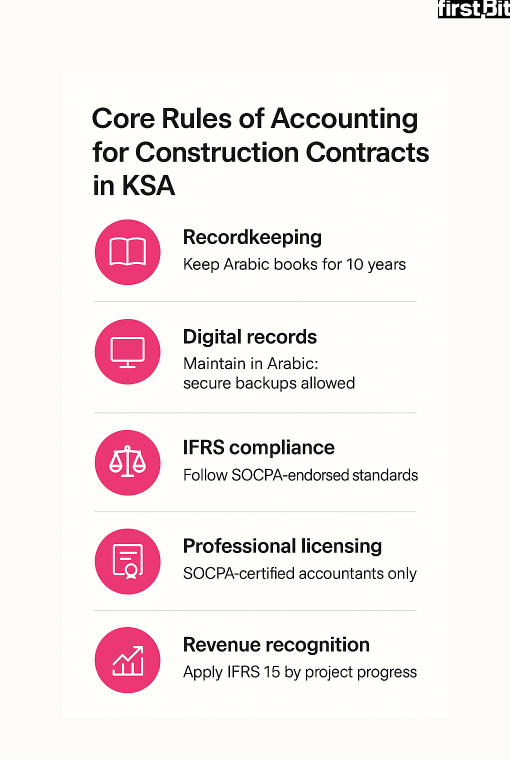

Core Rules of Accounting for Construction Contracts in KSA

Accounting rules for construction contracts

Once you understand the main regulatory bodies, the next step is applying their requirements in day-to-day construction accounting. Saudi Arabia’s framework combines long-standing commercial laws with modern IFRS-based reporting and strict tax compliance under ZATCA.

For companies managing projects under construction, this means every transaction from procurement to progress billing must meet both financial and regulatory accuracy.

Commercial Books and Record-Keeping Requirements

Under the Law of Commercial Books (Royal Decree No. M/61, 27 June 1989), all registered merchants are required to maintain ordered, Arabic-language commercial books, including a journal, general ledger, and inventory register that accurately reflect their financial condition.

Each record must be dated, numbered, and supported by verifiable evidence such as contracts, invoices, or payment vouchers. These records must be retained for at least ten years, allowing authorities to verify transactions whenever needed.

Smaller businesses may receive partial exemptions, but construction companies are expected to maintain complete, project-level documentation to demonstrate transparency and compliance.

In practice, this means every progress billing, variation order, and retention entry in accounting for construction contracts must be traceable. Using construction accounting software with automated logs and Arabic-language capability simplifies recordkeeping and ensures readiness for inspection.

Language, Format, and Electronic Records

All accounting records in Saudi Arabia must be kept in Arabic. While English or bilingual systems are acceptable internally, the official version submitted to regulators must remain in Arabic.

The Ministry of Commerce allows the use of digital accounting systems provided they ensure accuracy, traceability, and secure storage. Systems must follow prescribed numbering formats and include backup protocols.

For firms managing multiple large projects, a compliant accounting software for a construction company should include features like timestamped entries, secure cloud storage, and traceable user actions to meet these requirements.

Compliance with Accounting Standards and Reporting Deadlines

Saudi companies must prepare their financial statements under IFRS Accounting Standards as endorsed by SOCPA, along with additional pronouncements for local matters such as Zakat disclosures or Islamic financing.

Publicly accountable entities, including those involved in government or foreign-funded projects, must adhere to full IFRS. Financial statements should include a balance sheet, income statement, cash flow statement, and statement of changes in equity, all accompanied by an auditor’s report.

Under the updated Companies Law, these audited statements must be filed with the Ministry of Commerce within six months of the fiscal year-end. For construction firms, this deadline reinforces the need for accurate interim reporting and tight coordination between site progress and accounting entries.

Professional and Licensing Rules (SOCPA / Audit Profession)

The Law of the Profession of Accounting and Auditing (2021) requires accountants and auditors to be licensed under SOCPA and registered with the Ministry of Commerce. License holders must follow professional ethics, maintain continuing professional development (CPD), and retain working papers for defined periods.

Audit reports must be signed by a supervising licensed accountant or partner, who assumes full responsibility for the opinion issued. For construction businesses, working with SOCPA-licensed professionals ensures both compliance and credibility, especially when seeking bank financing or qualifying for public-sector tenders.

Revenue Recognition in Accounting for a Construction Company

Revenue from construction contracts is recognized under IFRS 15 – Revenue from Contracts with Customers, as endorsed by SOCPA. The standard defines a five-step model:

- Identify the contract(s) with the customer.

- Identify distinct performance obligations.

- Determine the transaction price, including variations and retention.

- Allocate the transaction price to performance obligations.

- Recognize revenue when or as performance obligations are satisfied.

For accounting for projects under construction, companies can use either the cost-to-cost method (based on incurred costs) or the output method (based on measurable completion milestones). The chosen method must be applied consistently and supported by documented evidence.

Each progress certificate, claim, or retention release must reconcile with revenue recognized under

IFRS 15. A capable construction accounting software can automate these calculations, align project cost data with revenue schedules, and maintain detailed records that meet both internal and external audit requirements.

ZATCA Compliance: Rules and Guidelines for Construction Accounting

Tax compliance is one of the most critical aspects of accounting for construction contracts in Saudi Arabia. The Zakat, Tax and Customs Authority (ZATCA) governs VAT, Zakat, and withholding tax (WHT), all of which shape how construction companies record income, expenses, and progress billing.

Tax audit assessments in Saudi Arabia yield around 6.5% of total tax collections, compared to an OECD average of 3.7% highlighting ZATCA’s increased focus on indirect tax audits and enforcement[?].

Overview of ZATCA and Its Role

ZATCA administers VAT, Zakat, income tax, and customs duties across the Kingdom. It issues circulars, guidelines, and rulings to ensure consistency in how taxes are applied and reported.

For construction firms, ZATCA’s role extends beyond collection; it audits large projects, monitors e-invoicing compliance, and verifies whether VAT has been properly applied on progress claims and subcontractor payments.

VAT Law and Implementing Regulations

Saudi Arabia’s VAT Law and its Implementing Regulations (IRs) define how VAT applies to goods, services, imports, and project-based work

[?].

The April 2025 amendments introduced stricter conditions for VAT grouping, clearer rules for nominal supplies, and a 30-day deadline for TOGC (transfer of going concern) notifications. They also updated provisions for special economic zones and zero-rating of certain cross-border services.

These revisions mean contractors must review how VAT is applied to retention money, design-build contracts, and inter-company billing within a group.

VAT Registration, Rates and Scope

Any entity providing taxable supplies above SAR 375,000 annually must register for VAT. The standard rate remains 15%, covering most construction materials, services, and consultancy work.

Certain supplies are zero-rated, such as exports or services to non-GCC clients, while residential property and government fees may be exempt.

Construction firms importing equipment or raw materials must account for import VAT at customs and record it accurately for input recovery within their construction accounting software.

E-Invoicing and Fatoorah Requirements

From December 2021, all VAT-registered businesses must issue e-invoices under ZATCA’s Fatoorah system. These invoices must include an XML format, a digital signature, and a QR code.

By 2025, integration with ZATCA’s platform will be mandatory for medium-to-large taxpayers. ERP or accounting software for construction company operations must now transmit invoice data automatically in real time.

Failure to comply may result in the following consequences:

Recordkeeping and Documentation Requirements

Taxpayers must keep detailed records of invoices, contracts, progress certificates, and supporting evidence for a minimum of six years, or ten years for real estate activities.

During audits, ZATCA may request verification of:

-

Progress claims

-

Retention releases

-

Input VAT documentation

Missing or inconsistent records often result in reassessments or denied input-tax deductions. Using compliant construction accounting software helps maintain this traceability across multiple projects and contractors.

Withholding Tax, Zakat, and Other Obligations

Payments to non-resident service providers (consultants, engineers, subcontractors) are subject to withholding tax ranging from 5% to 15%, depending on the service type and treaty coverage.

ZATCA also oversees Zakat filings for Saudi-owned entities. Because Zakat is calculated using financial statement data, consistency between accounting entries and tax disclosures is essential.

For hybrid ownership structures, contractors must reconcile Zakat, VAT, and WHT obligations together to avoid overlap or double-counting, something well-configured construction accounting software can automate.

VAT Compliance Tips in Accounting for Construction Contracts

VAT compliance for construction companies in Saudi Arabia requires precision at every stage, from drafting contracts to issuing invoices and recording progress payments. Errors in timing or documentation are among the most common reasons for VAT penalties, especially under ZATCA’s updated 2025 framework.

These guidelines help standardize accounting for construction contracts and ensure your VAT process aligns with ZATCA’s latest rules.

Align Contract Terms and VAT Clauses

Every construction contract must clearly define how VAT will be handled. Specify whether prices are VAT-inclusive or exclusive, who bears VAT on retention and variations, and how changes to the contract will be taxed.

Pro tip: The language should align with ZATCA’s construction-sector guidelines, which clarify definitions such as “construction services,” “mobilization advance,” and “retention.” This consistency between contract and accounting records prevents disputes and simplifies verification during audits.

Determine the Correct Date of Supply

VAT becomes due at the earliest of:

-

Invoice issuance

-

Payment receipt

-

Completion certification

For government contracts under the KSA procurement law, VAT liability arises on the date the payment order is issued.

Pro tip: Automating this process within your construction accounting software ensures each transaction is assigned the correct tax point, reducing the risk of misreporting or late VAT submission.

Handle Retention and Withheld Amounts Properly

Retention is a common area of confusion in accounting for construction company operations. VAT must always be calculated on the full contract value, not on the net amount after retention. When retention is released later, it should not be subject to VAT again if it was already included in the original invoice.

In ZATCA-compliant e-invoices, retention appears as an adjustment or allowance field, ensuring VAT is based on the total taxable amount.

Maintain Complete Documentation for Input VAT Recovery

Input VAT can only be recovered if supported by valid and traceable documentation, such as:

-

Invoices

-

Contracts

-

Delivery notes

-

Progress certificates

Under the 2025 VAT amendments, stricter controls apply to nominal supplies and restricted expense categories, meaning each claim must be verified before filing. A compliant construction accounting software should automatically match invoices to purchase orders and track the VAT deduction eligibility for each transaction.

Adapt to 2025 VAT Amendments and Transitional Rules

The April 2025 amendments to the VAT Implementing Regulations introduced stricter group membership criteria, clarified rules for nominal supplies, and set a 30-day deadline for TOGC notifications. Existing VAT groups have 180 days to adjust their structure.

Pro tip: Construction firms should review group memberships, intercompany billing, and internal workflows to ensure compliance across all projects under construction before the grace period ends.

Follow ZATCA’s Construction-Sector Guidelines

ZATCA’s official guideline for the construction and contracting sector clarifies industry-specific treatments for progress certificates, retention, and guarantees. Adopting these definitions into your internal VAT and project accounting policies ensures consistency across departments and minimizes interpretation issues during audits.

It also helps align your company’s internal controls with ZATCA’s expectations, a key step in building a strong compliance record.

SOCPA Compliance Tips in Accounting for Construction Contracts

SOCPA’s accounting framework is built on IFRS principles but customized for Saudi Arabia’s legal and cultural environment. For construction firms, compliance isn’t just about meeting audit requirements; it’s about ensuring that every figure in the financial statements reflects real project activity and Zakat obligations.

The following practices will help maintain accurate, SOCPA-compliant accounting for construction contracts while improving audit readiness and professional credibility.

Ensure Licensed Professionals and Proper Disclosures

Under Saudi law, all accountants and auditors must be licensed members of SOCPA. Unlicensed practice can invalidate audit reports and even delay project approvals with government clients.

These steps can help you prevent it:

-

Always verify that your external auditor or internal reviewer holds an active SOCPA license.

-

Audit reports, correspondence, and financial statements should display the license number, firm name, and supervising partner’s signature.

-

For in-house teams, ensure every accountant is registered on SOCPA’s database, as it supports credibility when submitting documentation to banks or authorities.

Maintain Audit Files and Financial Records for Long-Term Projects

SOCPA requires financial records and audit working papers to be kept for at least ten years, which is especially relevant for long-duration construction contracts. In practical terms, that means maintaining access to project cost summaries, client contracts, progress certificates, and bank confirmations even years after completion.

Pro tip: Use centralized storage ideally integrated into your construction accounting software to archive invoices, cost statements, and journal entries. This protects your company during Zakat assessments, tax audits, or project dispute reviews.

Keep Up with SOCPA-Endorsed IFRS Standards

Construction firms must follow IFRS as endorsed by SOCPA, which often includes local modifications for Zakat or Islamic finance.

Regularly review updates issued by SOCPA, for instance, IFRS 15 (Revenue Recognition) and IFRS 16 (Leases) have specific implications for equipment rentals, retention, and milestone-based payments.

Assign someone in your finance department to monitor these changes quarterly and update internal accounting policies. Maintaining a one-page “IFRS change log” helps auditors confirm that your accounting for projects under construction follows current interpretations.

Strengthen Transparency and Audit Quality

SOCPA now emphasizes greater audit transparency and independence reporting. Auditors must explain in their reports how independence threats were managed and disclose key judgments, such as how progress was measured or how contract revenue was estimated.

Pro tip: Encourage your auditors to include a clear explanation of accounting policies and estimation techniques specific to your construction projects. This not only builds investor and client confidence but also provides legal protection in case of disputes about project profitability.

Build Continuous Professional Competence (CPD)

SOCPA requires licensed professionals to complete a minimum of annual CPD hours to stay updated on IFRS and ethical standards.

Encourage your accountants to take courses on Zakat accounting, revenue recognition, and digital recordkeeping areas directly relevant to construction accounting. Maintain internal CPD records (certificates, attendance logs) in case of professional inspections by SOCPA or the Ministry of Commerce.

Note: Companies with well-trained accountants tend to close audits faster and face fewer queries during annual reviews.

Align Reporting for Zakat and Financial Statements

Many construction firms treat Zakat as a tax adjustment rather than an accounting component, leading to mismatches between financial statements and Zakat filings.

To stay compliant, ensure your financial data aligns with the Zakat-based calculation. This includes:

-

Working capital

-

Retained earnings

-

Financing structures

ТSOCPA encourages including Zakat-related disclosures in financial statements to promote transparency and reconcile tax positions accurately. These measures go beyond formal compliance; they create a consistent, auditable structure that connects financial statements with project realities.

Well-managed accounting for construction company operations not only meets SOCPA standards but also strengthens investor trust and improves the firm’s eligibility for public-sector projects.

How FirstBit Simplifies Accounting for Construction Companies

Managing accounting for construction contracts in Saudi Arabia means working within strict VAT, Zakat, and reporting frameworks, all while tracking costs across multiple projects.

FirstBit ERP brings these functions together in one platform built for the way contractors actually work.

Integrated Project and Financial Management

Each project’s BOQ, subcontractor invoice, and progress certificate are automatically linked to accounting entries, so cost and revenue updates flow directly into the ledger.

This integration removes manual reconciliations and ensures that your accounting for projects under construction always reflects real-time progress and approved variations.

Automated Compliance with ZATCA and SOCPA

FirstBit’s accounting module supports ZATCA-compliant e-invoicing (Fatoorah), VAT calculation, and Arabic-language reporting.

It also aligns with SOCPA-endorsed IFRS for financial statements, ensuring that progress billing, retentions, and material costs are recognized accurately for audit and Zakat purposes.

Real-Time Cost Control and Profit Tracking

Project dashboards display actual versus budgeted costs for labour, materials, and equipment.

Estimated vs actual cost graph in FirstBit ERP

Managers can identify overruns early, track resource utilization, and assess profitability by project phase or client, enabling tighter financial control across operations.

Multi-Entity and Consolidated Reporting

Many Saudi contractors operate multiple legal entities or joint ventures.

FirstBit enables multi-company accounting, intercompany billing, and consolidated financial statements, giving management a unified view of financial performance across all active projects.

Audit-Ready Financial Statements

The system automatically generates standardized reports, including balance sheets, income statements, and cash-flow statements in formats that comply with SOCPA-endorsed IFRS.

Each figure is traceable back to project-level transactions, simplifying audits and improving financial transparency for both internal and external stakeholders.

Centralized Recordkeeping and Document Control

All invoices, contracts, and progress certificates are stored in a secure digital archive with version control and backup.

This not only satisfies Saudi Arabia’s ten-year recordkeeping requirement but also streamlines document retrieval during audits or compliance checks.

Database backup feature in FirstBit ERP

By integrating compliance, project costing, and reporting in one system, FirstBit helps contractors maintain full visibility and control over their finances, ensuring that every aspect of their construction accounting software aligns with Saudi regulations and day-to-day project realities.

Conclusion

The accounting landscape for Saudi Arabia’s construction sector is evolving quickly. With SOCPA, ZATCA, and the Ministry of Commerce each tightening compliance expectations, contractors can no longer rely on fragmented systems or manual reporting.

That's why modern construction accounting software now integrates project costing, VAT compliance, Zakat calculations, and financial reporting in one platform. Solutions like

FirstBit ERP enable firms to manage accounting for construction contracts efficiently while staying ahead of evolving regulations.

With these systems in place, construction companies in Saudi Arabia can move beyond compliance toward full financial visibility, control, and long-term sustainability.

FAQ

What makes construction accounting different in Saudi Arabia?

Construction accounting in Saudi Arabia must follow SOCPA-endorsed IFRS standards and comply with ZATCA’s VAT and Zakat rules. Unlike standard accounting, it requires progress-based revenue recognition, project-level cost tracking, and e-invoicing integration aligned with Saudi regulatory requirements.

How does VAT apply to construction contracts in KSA?

Most construction services and materials are subject to 15% VAT. Contractors must issue ZATCA-compliant e-invoices under the Fatoorah system and record VAT on progress payments, retentions, and variations. Input VAT can only be recovered with valid supporting documentation.

What is phased revenue recognition, and why is it important?

Phased revenue recognition means recognizing income as work is completed, not when payments are received.

Under IFRS 15, construction firms must measure progress using cost-to-cost or milestone methods to present an accurate picture of project performance and financial position.

How does the system track costs across multiple projects?

The system uses project-based cost allocation, linking every expense from materials and labor to equipment and subcontractor costs to a specific project or cost center.

Each transaction updates in real time, allowing managers to compare actual versus budgeted costs and monitor profitability across all ongoing projects simultaneously.

Umme Aimon Shabbir

Editor at First Bit

Aimon brings a deep understanding of the modern construction business to her articles. Her strength is providing practical content that enhances users’ understanding and usage of the software in the industry. As an editor, Aimon helps our authors reach their full potential and produce their best work.